Today people shop and buy differently thanks to the internet – unsurprising. However when two landmark studies quantify the process of shopping, some surprises that have big implications to marketing emerge. Let’s start with the old thinking to better understand what’s new. (Will it be “Fun”? Of course it will. ;)

BOTTOM-LINE: Marketers need to understand how people shop today and align their activities accordingly to be most effective.

the traditional funnel

This outdated model was developed before the prevalence of the internet when there was a barrier to information. Consider: Consumer Reports was a trip to the library and advertising was actually considered somewhat trustworthy.

1 – A person will “recognize a need” and actively begin shopping.

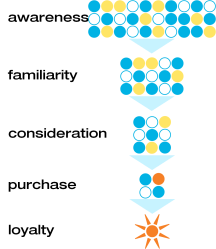

2 – People start with a large number of potential brands in mind. Being in this “Top of Mind” group of brands is the pay-off for “branding advertising”.

3 – Next people enter into a consideration phase. Here they compare features…no make that benefits – and methodically subtract brands in consideration until… This is when marketing pummels people with “push” advertising telling them why their brand is best…and it worked for a long time.

4 – Eventually, people emerge with a decision and purchase .

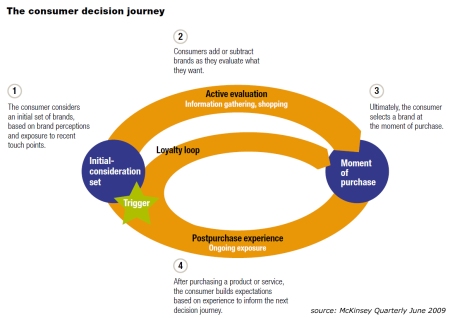

McKinsey & Co.’s Consumer Decision Journey

2008 – 20,000 consumers – 5 industries – 3 continents

You have to love our friends at McKinsey & Company as they always go BIG. In this study, McKinsey illustrates exactly why the Traditional Funnel no longer applies and how marketing should purposefully address the different stages of the consumer decision journey.

It begins with triggers that set people on the path of purchasing. (There are huge ideas here for real estate… ;)

STAGE 1 – Initial Consideration. People start off with certain brands in mind. Interestingly, there are not that many brands included in this initial consideration set. (Ranking the highest was Autos at only 3.8 brands.) (Getting into the Initial Consideration set is the pay-off for all that “branding advertising” marketers invest in. It seems wasted, until people are triggered and then remember you. However, this is only the beginning. If your marketing stops here – OUCH!)

STAGE 2 – Active Evaluation. Here people add and subtract brands as they evaluate what they want.

People aren’t just starting with a fixed pool of brand options and then whittling it down from there. They are starting with a small net and then expanding it to consider more brand options. (It’s in Active Evaluation that a new brand can enter in and knock an Initial Consideration competitor out of the running. If you’re not active in Stage 2…)

And to make things even more interesting, 67% of the information used in Active Evaluation involve consumer-driven marketing touchpoints (reviews, recommendations, past experiences, in-store interactions). Only 33% is company-driven. (So marketers would be well-advised to learn how to influence those consumer-driven touchpoints. Content marketing anyone? Social Media anyone? Experience Focus perhaps? Are you budgeting appropriately?)

STAGE 3 – Moment of Purchase. Ultimately, people emerge with a decision and purchase. It may be made on-line, in a store, or in a sales office.

STAGE 4 – Postpurchase Experience. After experiencing what they purchased, people will use the information to generate more consumer-driven information and the cycle continues.

Google’s Zero Moment of Truth.

2011 – 5,000 consumers – 12 industries – 1 continent

Rather than approach the purchasing decision journey from the consumer behavior perspective, Google look’s at the shopping dynamic through the lens of a marketing model by P&G. Continue reading